Your Direct Source For

1031 Exchange Real Estate

Offerings And Information

Why Direct 1031 Exchange?

Direct 1031 Exchange brings integrity and value to the 1031 exchange process by helping customers Retire from Running Your Real Estate ™. Our mission is to bring quality real estate investments directly to accredited investors. We strive to provide the potential for passive, diversified income while deferring taxes on capital gains and improving the lives of our investors.

Discovery → Analysis→ Implementation → Monitor

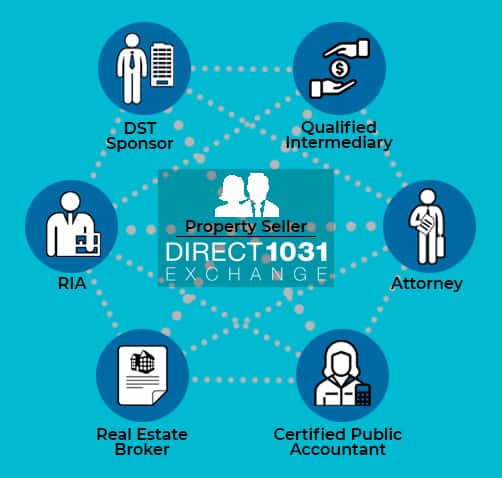

Direct 1031 Exchange Connects ALL of the Resources Necessary for a

Successful DST 1031 Exchange

Discovery

In the introductory meetings, we listen to you and determine if we can provide the

services required to meet your financial planning needs. We strive to provide a

comfortable and confidential place to discuss your personal situation without any sales pressure. We will focus on information gathering and a detailed discussion of your goals and priorities.

Analysis

Our Direct 1031 Exchange Principals analyze the information and collaborate to

develop appropriate strategies for each client and property. We present

recommendations and discuss options for your tax deferred exchange. We prioritize implementation based on your needs.

Implementation

Implementation is a partnership between you, the client/exchanger and Direct 1031

Exchange. Our team will coordinate your professional advisors including

Qualified Intermediary (QI), Real Estate broker, CPA and attorney. No Exchange is complete until all necessary resources are engaged and the DST 1031 Exchange is fully implemented and closed.

Continued Support

Direct 1031 Exchange keeps our clients/exchangers current on tax changes and

investment outlook in the 1031 Exchange market . We are also available to discuss any other questions regarding your real estate. In addition, clients/exchangers receive monthly reporting from the asset custodian.

Facilitating Your 1031 Exchange Through Every Step

Our highly skilled team is here to help you through the entire DST 1031 Exchange process. Whether you are just in the process of selling your property and need help finding a QI, or you are in the final days of needing to close on a property our team will make the process efficient and transparent.

CONTACT INFORMATION

4695 MacArthur Court, Suite 1100

Newport Beach, CA 92660

(866) 411-1031

invest@direct1031exchange.com

All properties shown are subject to availability. There can be no assurance that any of the properties shown will be available for investment. All properties shown are Regulation D Rule 506c offerings available to accredited investors only (generally defined as having a net worth of greater than 1 million dollars and/or an entity owned entirely of accredited individuals or having gross assets of over 5 million dollars – please speak with your CPA and attorney to determine if you and your investing entity are considered accredited prior to considering an investment). All real estate and DST properties contain risk. Please read the full private placement memorandum for a discussion of each properties business plan and risk factors. There are no guarantees for projected cash flow and/or appreciation. Please do not invest in real estate or DST properties if you cannot afford to lose your entire investment principal.

Diversification does not guarantee profits or protect against losses. This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). All offerings are subject to availability. There can be no assurance that any offering shown will be available for investment. Please be aware that this material cannot and does not replace the Memorandum and is qualified in its entirety by the Memorandum. This material is not intended as tax or legal advice so please do speak with your attorney and CPA prior to considering an investment. This material contains information that has been obtained from sources believed to be reliable. However, Direct 1031 Exchange, LLC and their representatives do not guarantee the accuracy and validity of the information herein.

Investors should perform their own investigations before considering any investment. There are material risks associated with investing in real estate, Delaware Statutory Trust (DST) properties and real estate securities including illiquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. For an investor to qualify for any type of investment, there are both financial requirements and suitability requirements that must match specific objectives, goals and risk tolerances. Diversification does not guarantee profits or protect against losses.

All photos are representative of the types of properties that Direct 1031 Exchange, LLC has worked with in the past. Investors will not be purchasing an interest in any of the properties depicted unless otherwise noted. IRC Section 1031, IRC Section 1033, and IRC Section 721 are complex tax codes; therefore, you should consult your tax and legal professional for details regarding your situation. All properties shown are Regulation D Rule 506c offerings available to accredited investors only (generally defined as having a net worth of greater than 1 million dollars and/or an entity owned entirely of accredited individuals or having gross assets of over 5 million dollars – please speak with your CPA and attorney to determine if you and your investing entity are considered accredited prior to considering an investment). All real estate and DST properties contain risk. Please read the full private placement memorandum for a discussion of each properties business plan and risk factors. There are no guarantees for projected cash flow and/or appreciation. Please do not invest in real estate or DST properties if you cannot afford to lose your entire investment principal.