Why The DST Structure?

A Delaware statutory trust or DST is a distinct legal entity created under Delaware law that may be used in a Section 1031 tax-deferred exchange. Under IRS Revenue Ruling 2004-86, a beneficial interest in the DST is treated as an undivided fractional interest in the DST’s real estate for federal income tax purposes. Direct 1031 Exchange complies with the requirements of IRS Revenue Ruling 2004-86. Each DST investor will be issued a tax opinion from a reputable law firm.

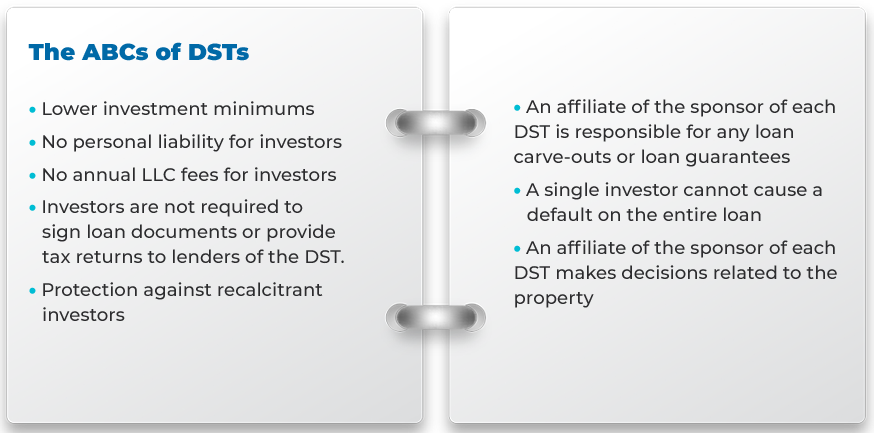

Potential Benefits of Participating in a DST

Tax Deferral

No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment. IRC Section 1031 (a)(1)

Rental Income

Objective is to pay rental income monthly

Quality Real Estate

Quality real estate leased by creditworthy tenants in properties of sufficient size to merit attention from investors who may purchase the DST's properties in the future.

Diversification

Mitigate exposure from a single property by acquiring a portfolio of DST real estate

Passive Investment

Avoiding the 3 Ts - toilets, tenants and trash

DST Restrictions for Qualification

DST trustees may not:

• Change existing loan terms or borrow new funds

• Accept financial contributions once an offering is closed

• Use proceeds from the sale of real estate to obtain new real estate (property must be

• exchanged under Section 1031 Guidelines)

• Make anything beyond minor repairs to a property

• Invest cash between distribution dates other than in short-term government debt

• Retain cash other than necessary reserves

• Enter into a new lease, or renegotiate the current

• lease, unless permitted under a master lease